In the summer of 2020, when the pandemic struck, our initial reactions included shock, misery and anger. The subsequent nationwide lockdown imposed on March 24, 2020, which lasted for over 60 days, made us resilient. Resilient because everyone struggled through unpredictability and the ‘new normal’, which included online offices, schools, doctor consultations, birthday parties which were unthought of. Then, we realized the importance of bare necessities like milk delivery, groceries, vegetables and fruits. Very soon, most of us adapted to this ‘new normal’, with home deliveries becoming more rampant than ever.

However, for the informal small businesses like ironing vendors, street-side food vendors, chai stall owners and thousands of other similar businesses, including small homepreneurs, for whom the lockdown was harsh in real terms. All of a sudden, they had lost all means of livelihood with no light at the end of the tunnel. Empty streets meant that vendors immediately lost their source of income, leaving them vulnerable.

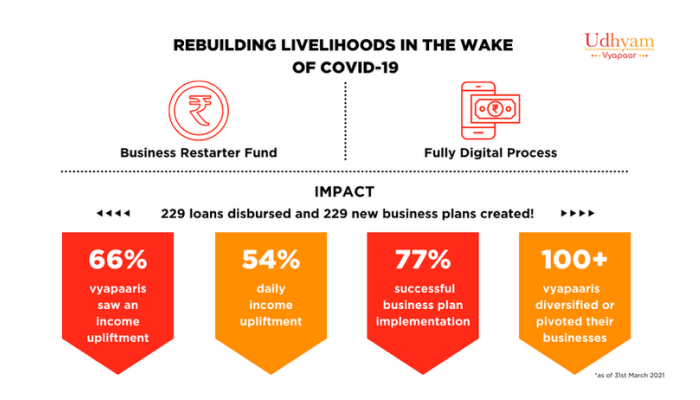

It was then that the team at Udhyam Vyapaar – who had been working with this cohort (we like to call them ‘vyapaaris’, a common term used for them in many parts of India) for a couple of years – started raising funds to disburse direct income benefits partly for basic sustenance needs and partly for restarting their livelihoods. Around 420 vyapaaris received a direct cash transfer of INR 5000 to their individual bank accounts. The understanding was they would use INR 3000 for their sustenance requirement and the remaining INR 2000 to restart their businesses. During this time, the team also realized that the direct income transfer of INR 5000 was not enough, and there was an immediate need for further business-restarter funds.

Ideation

Many reports and our own assessments reveal that the income of these small businesses had plummeted by 50-70% post the first wave of COVID19.

- Business restarter Fund

INR 5000 was good enough for them to sustain during the lockdown and bring them back to their business; however, more money was required to keep the lights on. They had to restart their businesses to earn an income to feed themselves and their families. Restarting the business required capital, to stock up inventory, etc.

- Lack of borrowings from organized FI’s

Financial institutions stay away from lending to this cohort, fearing non-repayments; in addition, there is a shortage of financial products for this cohort. They don’t always have the necessary paperwork and documentation to access these loans. EMI, an equated monthly installment, does not always work for this cohort as they earn and spend daily. Udhyam Vyapaar undertook the initiative to devise a micro-credit offering tailor-made for this cohort. We started approaching CSRs / foundations / HNIs to raise funds. The CSR grants of INR 25 lakhs enabled us to roll out micro-credit offerings of INR 10000 each to 250 nano-businesses.

Features

The intent behind this product was not for it to only be a fund deployment model, we also wanted to ensure that funds got utilized towards the ultimate goal of reviving the nano-business.

Borrower selection for availing the loan was based on:

- Business must have a UPI ID – This meant that habit-building for online payments was done before disbursement. In the case of those who did not have a UPI ID, we trained them to have one and use it. Once they proved evidence of operating UPIs, they received the loan money

- Charcha – a brief loan interview to understand the candidate / vyapaari better

- Submission of a Business plan, including how funds would be used – This was done to make sure that the funds are utilized astutely

- Online KYC

Salient features of this micro-credit offering are:

- Zero-percent interest loans: Moneylenders charge exorbitant interest rates, whereas this was a zero-interest loan.

- No collaterals/security were taken from these businesses

- Introduced vyapaari friendly tools: Creating a vyapaari friendly business plan format led to the utilization of funds in the business, resulting in income upliftment. The plan helped businesses diversify or scale upon the existing product lines.

- Hassle-free repayments: Everyday repayment of INR 100 for 100 days was modeled after a prevalent practice of informal lendings for this audience.

- Encouraging peer-to-peer networking: A virtual community of borrowers was created through the WhatsApp group. This community assists in peer-to-peer learning, socialization, promotion and problem-solving. There were many instances of vyapaaris from similar backgrounds (business/linguistic) forming subgroups and offering support to each other.

Among the few stories that stood out, one was about a printing press vyapaari regularly posting updates about how other vyapaaris can avail his services at a discount. There was another vyapaari called Vishal, who started a new shop and invited the group for the inauguration. These groups acted like support groups providing opportunities to share their experiences, first-hand information and much more:

- During the second wave, in the Vyapaari Sabha, people from different lines of business came in to attend the sessions. They shared their apprehensions about business shutdown and survival during the pandemic.

- For repayment, the group acts as a reminder. Towards the end of the day, when part of the vyapaari group starts repaying, it reminds their peers and nudges others too to make their repayment for the day.

- There were examples of homepreneurs who transitioned their businesses online, sharing their collections/products within the group and asking other vyapaaris to support and forward it within their network.